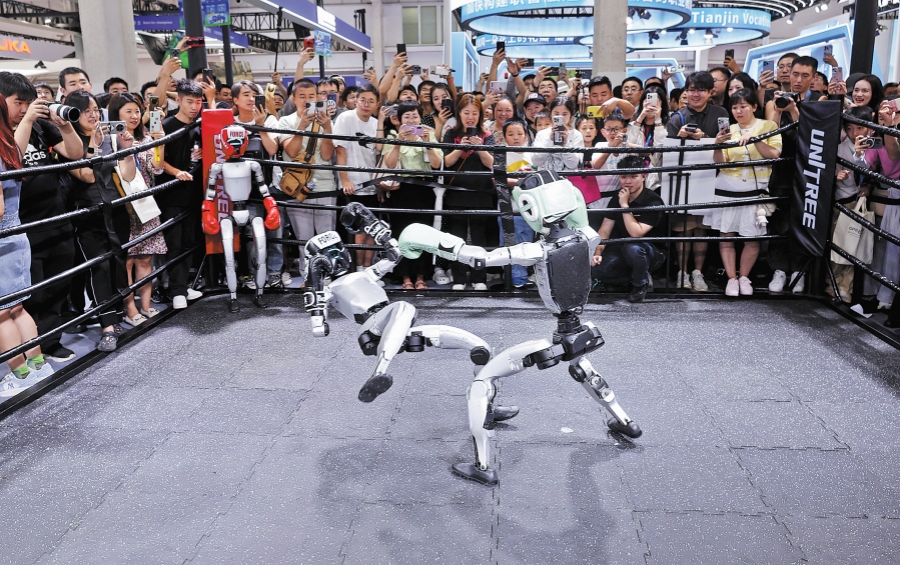

Unitree cuts robot prices for wider mkt penetration

China's Unitree Robotics is cutting prices of its latest humanoid robot models as it pushes toward commercialization, with founder and CEO Wang Xingxing predicting that one day the government could tax robots the way they tax human workers.

In an exclusive interview with China Daily at the World Robot Conference in Beijing, Wang said the next few years will see Chinese robots become "undoubtedly cheaper", as Unitree has already cut prices of its R1 humanoid robot to 39,900 yuan ($5,555).

"The move is not a simple discounting tactic but a deliberate push to lower the entry barrier for buyers, stimulate demand and accelerate the creation of a broader commercial ecosystem," Wang said.

The ultimate goal, Wang said, is that robots can work "as efficiently as humans", where humanoids are accessible through leasing programs for factories, farms or households, and where a vibrant developer community constantly builds new applications to augment the machines.

"We could see such obvious progress in two to three years," he said, adding that full realization would take no more than a decade.

In an intriguing aside, Wang floated the idea of taxing robots at the point of production once they are capable of doing "a large share of human work". If a robot is deployed to plough new farmland, a portion of its output could be remitted directly to the government, just as a human's income is taxed, he said.

As for Unitree's IPO plans, Wang said the process is "by the book "and that the listing will be a milestone in governance. "It's like taking the gaokao," he said, referring to China's national college entrance exam. "It's a stage-by-stage thing — a summary of nine years of work, and an answer sheet for our shareholders."

According to an industry report published in April, China will produce more than 10,000 humanoid robots by the end of this year and will dominate more than half of the global humanoid robot market this year.

With costs falling and ecosystems maturing, the humanoid robot industry is poised to leap from pilot projects to large-scale commercialization. It is a path "reminiscent of China's rapid rise in electric vehicles" and it could give the country a fresh economic growth engine, said the report.

Wang said half of Unitree's revenue already comes from overseas, thanks to an early export push in 2018, long before humanoid robots became fashionable.

"Global humanoid shipments are expected to double annually, and if breakthroughs come sooner, the sector will hit hundreds of thousands of units in two to three years," he predicts.

He said that the global humanoid robot race was intensifying amid a surge of investment and attention driven by artificial intelligence. But the fundamentals have not changed.

"Better products, better prices, better functions, better after-sales service — that's the foundation to compete at home and abroad."

Strategic planning must stay ahead of the curve, he said, with early bets in AI, hardware, manufacturing and global expansion.

While hardware still needs to be cheaper, be larger-scale and more reliable, Wang said the biggest obstacle to mass deployment is the embodied-intelligence AI model, which unlike language models, has yet to hit a breakthrough "ChatGPT moment".

"If one day every humanoid robot in a hall can just walk around, take verbal instructions and actually help you, that's the tipping point," Wang said.

The difficulty is "data alignment" — bridging the gap between virtual training data and the performance of real-world machines. Unitree is targeting models that require little data, have high success rates and generalize well, he added.

Wang Tianmiao, a professor of robotics at Beihang University, said in a separate interview that humanoid robots are being positioned to meet human needs and drive business efficiency.

"China is vying for a lead in next-gen tech, including AI and robotics, which are right at the heart of that race," the professor said.

chengyu@chinadaily.com.cn