Manufacturing upgrades prioritized

Efforts urged to hasten cultivation of emerging global pillar industries

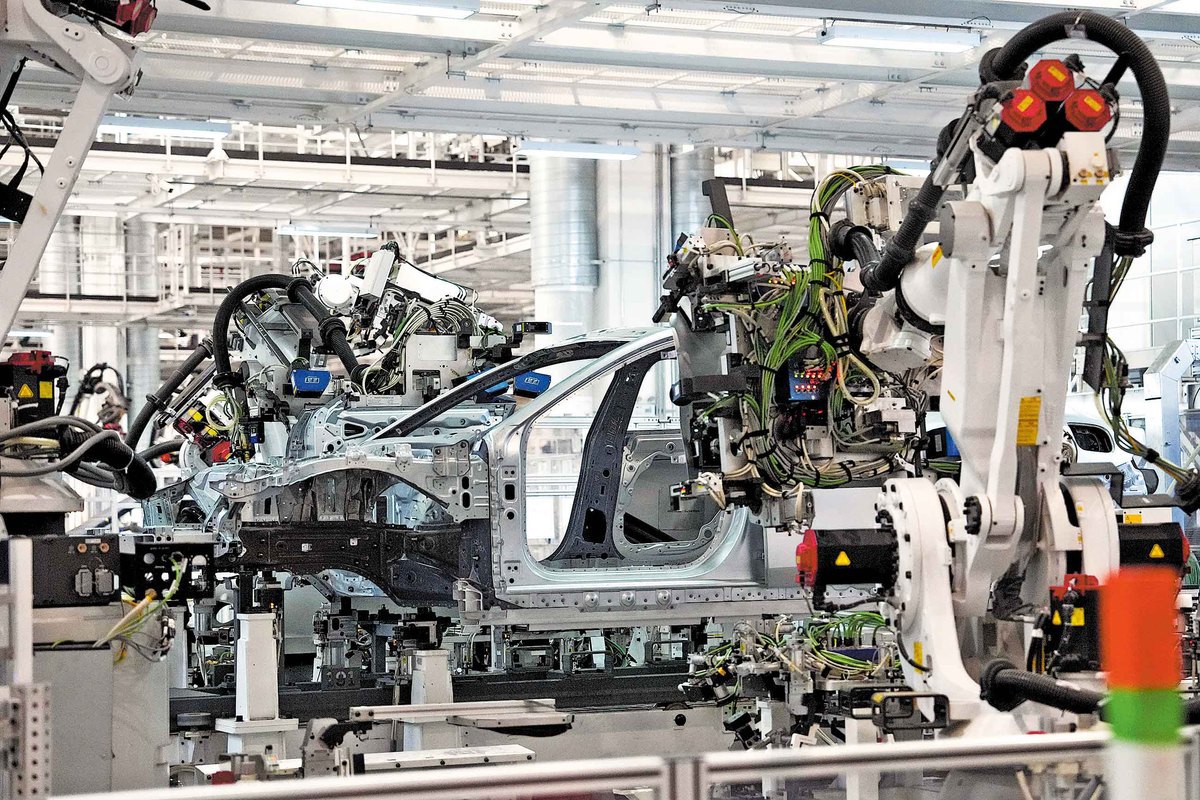

Chinese financial authorities and institutions are likely to step up coordinated efforts to amplify support for manufacturing upgrades as part of the country's broader commitment to advancing new quality productive forces, analysts said on Wednesday.

They commented after the People's Bank of China, the country's central bank, released a guideline on Tuesday regarding amplifying financial support for new industrialization, together with the Ministry of Industry and Information Technology and five other central government departments.

The guideline, containing 18 sets of specific measures, said the country aims to develop a financial system by 2027 that is more effective in supporting the high-end, intelligent and green development of the manufacturing sector.

"A targeted and differentiated approach shall be maintained, combining support with restrictions, to accelerate the industrial sector's move toward mid-to-high end, while preventing excessive competition," the guideline said, adding that by 2027, the number and scale of bond issuances by manufacturers will see continuous growth, while equity financing will be significantly enhanced, fully meeting the effective credit demand from manufacturers.

The guideline was released after a top-level meeting last week called for efforts to accelerate the cultivation of emerging pillar industries with global competitiveness and promote the deep integration and development of sci-tech and industrial innovation.

Liu Dian, an associate research fellow at Fudan University's China Institute, said: "New industrialization is not just about the expansion of manufacturing, but about upgrading toward greater sophistication, intelligence and sustainability. This requires the financial system to shift from supporting the manufacturing sector expanding in size to helping the sector optimize its structure and control risks, and to build a financial supply mechanism that is more adaptive to these requirements."

According to the guideline, financial products will become more diversified, and various instruments — such as loans, bonds, equity and insurance — will be more closely coordinated and integrated under the premise of effectively preventing cross-sector financial risks.

Eligible enterprises in emerging industries — including next-generation information technology, basic and industrial software, intelligent and connected vehicles, new energy, new materials, high-end equipment, spatiotemporal information, commercial aerospace, biopharmaceuticals, cybersecurity and data security — will be supported in raising funds through the multitiered capital market.

Looking ahead, Liu said overcoming bottlenecks of key technologies and ensuring the security of industrial and supply chains are likely to be the focus of the stepped-up financial support.

Encouraging more participation of long-term capital is essential to help address challenges such as the difficulty of translating scientific research into commercial applications, he said, adding that refinements in rules are needed to guide long-term investment in future industries, enabling greater risk tolerance and acceptance of delayed returns.

The guideline said that long-term capital — including government investment funds, State-owned enterprise funds and insurance companies — will be encouraged to accelerate investment in future industries such as manufacturing, information, materials, energy, space and health.

It also called for leveraging structural monetary policy tools to encourage medium and long-term financing from banks to overcome technological bottlenecks and develop critical products in key sectors, such as integrated circuits, medical equipment, servers, instruments and measurement devices, basic software, industrial software and advanced materials.

Dong Ximiao, chief researcher at Merchants Union Consumer Finance, said that the guideline will promote closer cooperation among financial institutions, regulators, industries and enterprises in areas such as policy formulation and talent development, thus enhancing the effectiveness of financial services for new industrialization.

Dong added that the measures outlined in the guideline also form an important part of the financial sector's own efforts to accelerate structural adjustment.